For professionals and families

For professionals and families

Plannix is the independent financial advisory platform that helps you define a clear and personalized investment plan, without conflicts of interest or hidden costs.

Over 3000 people have tried it

Over 3000 people have tried it

The independent financial advisory platform

Independence from banks, insurance companies, and other management firms is the pillar of our ethics. We have no hidden interests or incentives to recommend holdings and solutions. Every piece of information you will find in Plannix is designed for your utmost benefit, as our interests are completely aligned with yours.

Independence from banks, insurance companies, and other management firms is the cornerstone of our ethics. We do not have, and will not have, any hidden interests or incentives to recommend holdings and solutions to you. Every piece of information you find in Plannix is designed for your maximum benefit, because our interests are completely aligned with yours.

Independence from banks, insurance companies, and other management firms is the cornerstone of our ethics. We do not and will not have any hidden interests or incentives to recommend holdings and solutions to you. Every piece of information you find on Plannix is designed for your maximum benefit because our interests are completely aligned with yours.

Connect your accounts to have your data at your fingertips in no time.

Automatic Connection

Connect your accounts to have your data at your fingertips in no time.

Automatic Connection

The Plannix method is always updated and available, even on mobile.

New training area

The Plannix method is always updated and available, even on mobile.

New training area

Analyze your financial health and investment costs quickly and in real-time.

Automatic Analysis

Analyze your financial health and investment costs quickly and in real-time.

Automatic Analysis

Optimize income and expenses with clear annual planning.

Budgeting

Optimize income and expenses with clear annual planning.

Budgeting

Simulate operations to bring the portfolio back to the desired asset allocation or create your own PAC.

Rebalancing and SIP

Simulate operations to bring the portfolio back to the desired asset allocation or create your own PAC.

Rebalancing and SIP

Track all your investments and create individual customized Portfolios.

Investments and Portfolios

Track all your investments and create individual customized Portfolios.

Investments and Portfolios

Spoiler: updates coming soon

In 2025, amazing new features are coming.

By subscribing today, you will get all the innovations of 2025 for the platform, including:

Automatic loading of financial holdings

Separation between family and personal assets

Automated periodic analysis reporting

Spoiler: updates coming soon

In 2025, amazing new features are coming.

By joining today, you take home all the new features of 2025 for the platform, including:

Automatic uploading of financial holdings

Separation between family and personal assets

Automated periodic analysis reporting

Spoiler: updates coming soon

In 2025, amazing new features are coming.

Subscribe today and bring home all the 2025 updates for the platform, including:

Automatic upload of financial holdings

Separation between family and personal assets

Automated periodic analysis reporting

Why Plannix?

The 21 questions you will find answers to in Plannix

Che cosa ne faccio della liquidità che ho a disposizione?

Che cosa ne faccio della liquidità che ho a disposizione?

Che cosa ne faccio della liquidità che ho a disposizione?

PSD2 and Open Banking

Connect your accounts securely

and with just a couple of clicks

Connect your accounts securely

with just a couple of clicks

Securely connect your accounts with just a couple of clicks

We integrate over 4,000 banks across Europe with a secure and protected connection in accordance with the EU PSD2 Directive (2015/2366).

We integrate over 4,000 banks across Europe with a secure and protected connection in accordance with the EU PSD2 Directive (2015/2366).

Plannix uses Salt Edge Inc. and GoCardless Ltd as providers for open banking solutions. Salt Edge Inc. and GoCardless Ltd are authorized at the Italian and European levels as connectors to banking institutions and data normalizers according to the PSD2 directive. The user primarily authorizes SaltEdge Inc. and/or GoCardless Ltd to connect with their banking and/or financial intermediary, and subsequently authorizes Plannix to join and consult their data saved by SaltEdge Inc. and/or GoCardless Ltd within their infrastructure. Salt Edge Inc. and GoCardless Ltd are responsible for maintaining the connection and updating the user's data in an automated manner, following the PSD2 directives and using their security and privacy protocols. By granting Plannix access to the synchronized data in SaltEdge Inc. and/or in GoCardless Ltd through TLS encrypted channels, the user never authorizes Plannix, under any circumstances, to read or retrieve data directly from the banking intermediary’s systems. At any time and for any reason, the user may revoke the authorization for SaltEdge Inc. and/or GoCardless Ltd to read their data from the intermediary’s systems, as well as revoke Plannix’s access to the synchronized data on SaltEdge Inc. and/or on GoCardless Ltd, even before the automatic expiration.

Analyze

The guided check-up of your financial situation

Only what is measurable can be improved. That's why Plannix allows you to analyze your holdings, know your financial health, and track your investments, holdings, and portfolios, without the need for unnecessary complex Excels. Performance indicators tell you how you are doing and what you should focus on to improve.

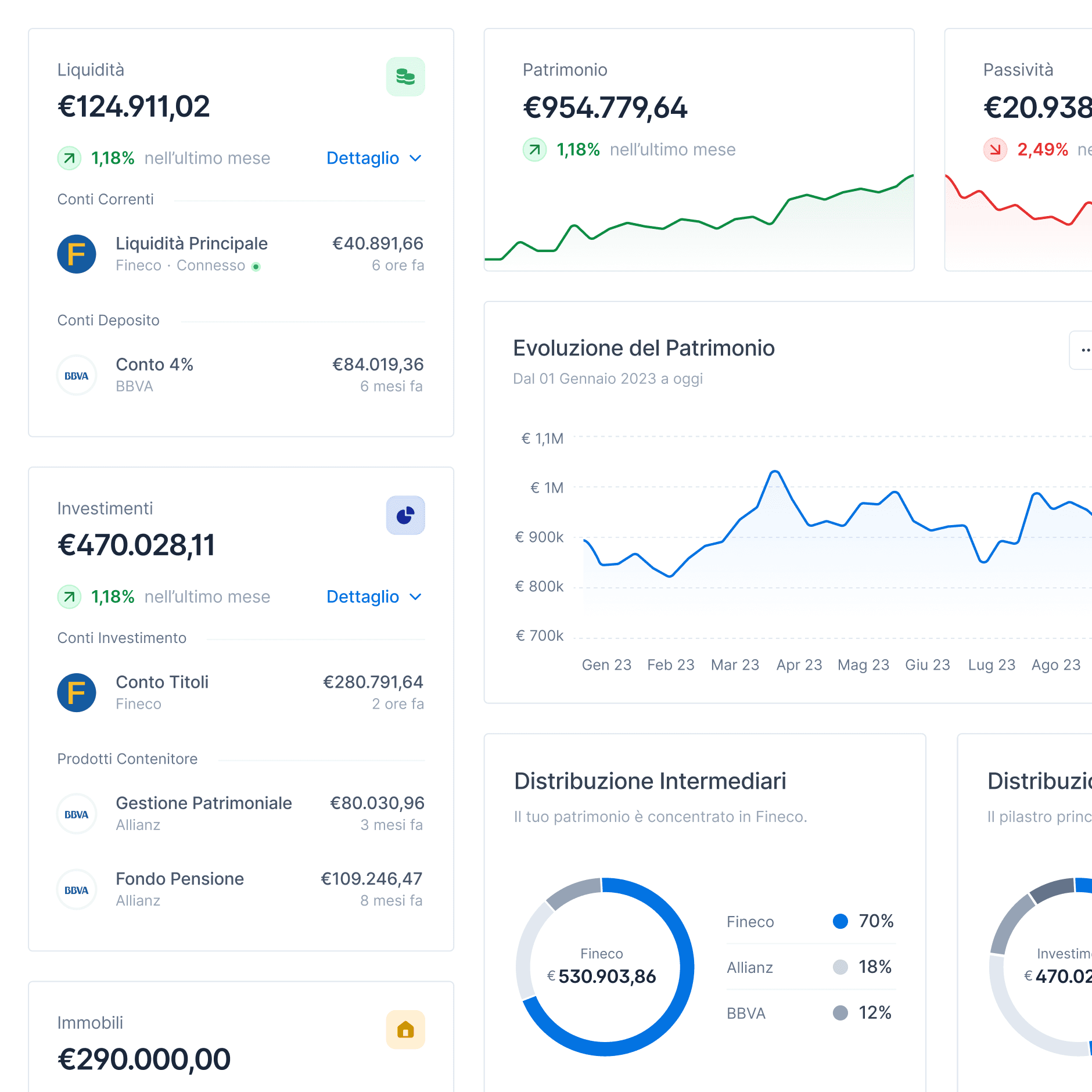

Wealth Overview

Net Worth Tracker

Investment Tracking

Monitor the performance

Financial Health and Indicators

Discover how to improve

Wealth Overview

Add all your assets and keep your wealth in check with important information at your fingertips.

Connect your accounts in just a few clicks and synchronize the balance with total security.

Automatically connect the accounts

Checking accounts, ETFs, Mutual funds, Stocks, Bonds, Insurance policies, Wealth management, Pension funds, Real estate, and Crypto: everything in one place

Add all your assets

Wealth Overview

Track Your Net Worth

Investment Tracking

Monitor the performance

Financial Health and Indicators

Discover how to improve

Wealth Overview

Add all your assets and keep your wealth in check with important information at your fingertips.

Connect your accounts in just a few clicks and synchronize the balance with total security.

Automatically connect the accounts

Checking accounts, ETFs, Mutual funds, Stocks, Bonds, Insurance policies, Wealth management, Pension funds, Real estate, and Crypto: everything in one place

Add all your assets

Wealth Overview

Add all your assets and keep your wealth in check with important information at your fingertips.

Connect your accounts in just a few clicks and synchronize the balance with total security.

Automatically connect the accounts

Checking accounts, ETFs, Mutual funds, Stocks, Bonds, Insurance policies, Wealth management, Pension funds, Real estate, and Crypto: everything in one place

Add all your assets

Develop your plan

Secure your financial future

Create a financial plan that protects you and your family from issues and unforeseen events, ensuring your future retirement, paying for your children's college, or providing for your elderly parents.

Simulators and Calculators

Use our simulators to better estimate the different scenarios that will make up your financial plan.

Develop Financial Plans

Investment goals

Develop your plan

Secure your financial future

Create a financial plan that protects you and your family from issues and unforeseen events, ensuring your future retirement, paying for your children's college, or providing for your elderly parents.

Simulators and Calculators

Use our simulators to better estimate the different scenarios that will make up your financial plan.

Develop Financial Plans

Investment goals

Develop your plan

Secure your financial future

Create a financial plan that protects you and your family from issues and unforeseen events, ensuring your future retirement, paying for your children's college, or providing for your elderly parents.

Simulators and Calculators

Use our simulators to better estimate the different scenarios that will make up your financial plan.

Develop Financial Plans

Investment goals

Simulate Scenarios

Every feature is designed to make your life as an investor simpler.

Every feature is designed to make your life as an investor simpler.

Gain clarity, peace of mind, and an overview.

Gain clarity, peace of mind, and an overview.

Retirement Simulator

Simulate your old-age, disability, inability, and survivors' pensions.

Future Capital Calculator

Discover how much your assets and savings can grow over time.

Future Income Calculator

Discover how much you need to live off your investments based on the standard of living you desire.

Would you like to become independent but are afraid of making mistakes?

Don't worry, with Plannix Premium you have 3 planning consultation sessions included, where you can collaborate with your personal tutor who will guide you throughout the entire process. You will never be left alone, promised!

Would you like to become independent but are afraid of making mistakes?

Don't worry, with Plannix Premium you have 3 planning consultation sessions included, where you can collaborate with your personal tutor who will guide you throughout the entire process. You will never be left alone, promised!

Throughout the year, you will have three planning consultation sessions with your tutor, which will help you to:

unblock yourself in case you get stuck at any point in the process;

review your overall financial situation to identify possible improvements;

understand if what you are doing is correct;

receive support to overcome any anxieties or fears that may arise during the journey.

First Session - Start

This is an initial session where the tutor will give you a comprehensive tour of the platform, define the next goals with you, and resolve any issues you have encountered along the way.

First Session - Start

This is an initial session where the tutor will give you a comprehensive tour of the platform, define the next goals with you, and resolve any issues you have encountered along the way.

Halfway point - Check

The mid-year session (or even earlier if you feel the need) to check progress, make any necessary adjustments to the plan, and help you overcome any doubts and fears along the way.

Halfway point - Check

The mid-year session (or even earlier if you feel the need) to check progress, make any necessary adjustments to the plan, and help you overcome any doubts and fears along the way.

Year-end Review

The final call to evaluate the results, consolidate the achievements reached, and plan the next steps.

Year-end Review

The final call to evaluate the results, consolidate the achievements reached, and plan the next steps.

Would you like to become independent but are afraid of making mistakes?

Don't worry, with Plannix Premium you have 3 planning consultation sessions included, where you can collaborate with your personal tutor who will guide you throughout the entire process. You will never be left alone, promised!

Throughout the year, you will have three planning consultation sessions with your tutor, which will help you to:

unblock yourself in case you get stuck at any point in the process;

review your overall financial situation to identify possible improvements;

understand if what you are doing is correct;

receive support to overcome any anxieties or fears that may arise during the journey.

First Session - Start

This is an initial session where the tutor will give you a comprehensive tour of the platform, define the next goals with you, and resolve any issues you have encountered along the way.

Halfway point - Check

The mid-year session (or even earlier if you feel the need) to check progress, make any necessary adjustments to the plan, and help you overcome any doubts and fears along the way.

Year-end Review

The final call to evaluate the results, consolidate the achievements reached, and plan the next steps.

Security and Privacy

The security of your data comes first

The security of your data comes first

Your data is encrypted, protected, and secure. We use it solely to provide you with analysis and statistics, and we will never sell it to third parties.

Your data is then anonymized: it is never possible to trace back to the identity of the holder of the sensitive data. The user-data association is programmatically generated through a unique random code that is assigned to the user upon joining.

wVISQaB92n804s

r9H4DnOj6LVw2C

Based on your preferences

Plannix is completely customizable based on your data.

PAC

Attention

Import

Balancing

Edit

Act

Helpful feedback

Receive the truly important feedback.

Tutor and guided checkup

All the support you need.

Connect

Add transactions

Keep track of your assets over time.

Add transactions

Keep track of your assets over time.

Make Excel retire

Advanced tables with filters and search

Based on your preferences

Plannix is completely customizable based on your data.

PAC

Attention

Import

Balancing

Edit

Act

Tutor and guided checkup

All the support you need.

Connect

Add transactions

Keep track of your assets over time.

Add transactions

Keep track of your assets over time.

Make Excel retire

Advanced tables with filters and search

Based on your preferences

Plannix is completely customizable based on your data.

PAC

Attention

Import

Balancing

Edit

Act

Helpful feedback

Receive the truly important feedback.

Tutor and guided checkup

All the support you need.

Connect

Add transactions

Keep track of your assets over time.

Make Excel retire

Advanced tables with filters and search

Who is Plannix suitable for?

The right solution for those with capital or a good saving ability

The right solution for those with capital or a good saving ability

To make the most of all the features of Plannix, we recommend having a minimum of holdings or, alternatively, a capacity for recurring savings. Here are some of the use cases in which you might find yourself.

To make the most of all the features of Plannix, you need to have a capital of at least €50,000 or alternatively, a savings capacity of at least €800 per month. Here are some of the use cases in which you might find yourself.

To make the most of all Plannix's capabilities, we recommend having a minimum of holdings or, alternatively, a capacity for recurring savings. Here are some of the use cases you might find yourself in.

If you have never invested

Plannix is also suitable for those who have never invested anything but want to understand more about the financial world.

If you have never invested

Plannix is also suitable for those who have never invested anything but want to understand more about the financial world.

If you have never invested

Plannix is also suitable for those who have never invested anything but want to understand more about the financial world.

If you don't trust the alternatives

Plannix is right for you if you are disappointed with previous financial experiences and are looking for an alternative.

If you don't trust the alternatives

Plannix is right for you if you are disappointed with previous financial experiences and are looking for an alternative.

If you don't trust the alternatives

Plannix is right for you if you are disappointed with previous financial experiences and are looking for an alternative.

If you haven’t earned enough

Plannix is the perfect solution if you are unsatisfied with the results of your investments.

If you haven’t earned enough

Plannix is the perfect solution if you are unsatisfied with the results of your investments.

If you haven’t earned enough

Plannix is the perfect solution if you are unsatisfied with the results of your investments.

If you're afraid of doing it all by yourself

With the assistance and tutoring sessions on using the platform, Plannix will be your financial co-pilot.

If you're afraid of doing it all by yourself

With the assistance and tutoring sessions on using the platform, Plannix will be your financial co-pilot.

If you're afraid of doing it all by yourself

With the assistance and tutoring sessions on using the platform, Plannix will be your financial co-pilot.

If you manage the household economy

Plannix is right for you if you need to take care of elderly parents or young children and make important financial decisions.

If you manage the household economy

Plannix is right for you if you need to take care of elderly parents or young children and make important financial decisions.

If you manage the household economy

Plannix is right for you if you need to take care of elderly parents or young children and make important financial decisions.

If you are looking for feedback and confirmations

Even if you already have a financial plan, Plannix is an excellent tool to assess its effectiveness.

If you are looking for feedback and confirmations

Even if you already have a financial plan, Plannix is an excellent tool to assess its effectiveness.

If you are looking for feedback and confirmations

Even if you already have a financial plan, Plannix is an excellent tool to assess its effectiveness.

What's in Plannix?

Training, platform and financial planning consultancy.

Training, platform and financial planning consultancy.

The best financial education and training, Plannix's advanced technology platform for simulation and monitoring your holdings, and our five-star planning consultancy to guide and assist you. These are the 3 pillars of Plannix.

The best financial education and training, Plannix's advanced technology platform for simulation and monitoring your holdings, and our five-star planning consultancy to guide and assist you. These are the 3 pillars of Plannix.

Financial education and training

The Plannix process is the foundation to start from, and you can follow everything in convenient videos. You will find unmissable lessons with teachings that will accompany you for a lifetime.

Technological platform

With Plannix, you can simulate scenarios, track your holdings, monitor your portfolios, and get an overview of your financial plan. All in one.

Financial planning consultations

Plannix includes 3 sessions of general advice and planning: we are by your side to assist and guide you on your journey.

+20

Years of experience of the team

Years of experience of the team

4.9/5

Our rating on Trustpilot

Our rating on Trustpilot

257 Million

The total holdings of the clients we have offered consulting to

The total holdings of the clients we have offered consulting to

Over 3000 people have tried it

News 2025

4 live "Market Insights" events with Luca

4 live "Market Insights" events with Luca

In 2025, "Market Insights" are coming, four live digital events that will take you to explore financial markets and our model portfolios.

You will discover the reasons behind certain choices, how your portfolios are performing, and what is influencing their performance.

Each event includes a live Q&A session directly with Luca.

Financial markets will no longer hold secrets for you!

News 2025

4 live "Market Insights" events with Luca

In 2025, "Market Insights" are coming, four live digital events that will take you to explore financial markets and our model portfolios.

You will discover the reasons behind certain choices, how your portfolios are performing, and what is influencing their performance.

Each event includes a live Q&A session directly with Luca.

Financial markets will no longer hold secrets for you!

Start your journey today

Join Plannix now

Create your account and start growing your holdings and securing your financial future today.

Paga in 3 rate con

Smart

€2,520

€990

per year

🎓 The new Financial Planning course (worth €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value €790)

NOVITÀ: 4 Eventi in diretta “Market Insights” per scoprire i retroscena dei mercati finanziari e diventare l’esperto di finanza tra i tuoi colleghi e amici (valore 390€)

Financial Growth

🔗 Automatic connection to your bank account for automatic tracking

📊 Asset and Investment Tracker

🔍 Financial Health Report and KPIs

💰 Detailed report of investment costs

Plan and Achieve Your Goals

📈 Create financial plans suited for you

🧮 Simulators and Calculators for informed decisions

📉 Optimize your investments with model portfolios

⚖️ Easy rebalancing to maintain portfolio equilibrium

💸 PAC: Guided Savings Plans for your investments

SUPPORT AND UPDATES

🔄 1 year of assistance and updates

📧 Email Support

💬 Live chat support

🤑 30-day Guarantee

Premium

€3,310

€1,490

per year

🎓 The new Financial Planning course (value €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value of €790)

NEWS: 4 Live 'Market Insights' events to discover behind-the-scenes of financial markets and become the finance expert among your colleagues and friends (value €390)

Everything included in the Smart plan

PLANNING SESSIONS

Assessment of the initial situation

Analysis of existing investments

Definition of steps and objectives

Financial plan assessment

Assessment of Insurance Holdings

12-month Check-up

End-of-year plan review

Analysis of areas for improvement

Savings verification

Private

Starting from

€4,900

per year

Everything included in the Premium plan

Customized and individual Financial Consulting

Dedicated 1:1 financial advisor

Dedicated to Net Worth over €500,000

The service has limited spots.

Paga in 3 rate con

Smart

€2,520

€990

per year

🎓 The new Financial Planning course (worth €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value €790)

NOVITÀ: 4 Eventi in diretta “Market Insights” per scoprire i retroscena dei mercati finanziari e diventare l’esperto di finanza tra i tuoi colleghi e amici (valore 390€)

Financial Growth

🔗 Automatic connection to your bank account for automatic tracking

📊 Asset and Investment Tracker

🔍 Financial Health Report and KPIs

💰 Detailed report of investment costs

Plan and Achieve Your Goals

📈 Create financial plans suited for you

🧮 Simulators and Calculators for informed decisions

📉 Optimize your investments with model portfolios

⚖️ Easy rebalancing to maintain portfolio equilibrium

💸 PAC: Guided Savings Plans for your investments

SUPPORT AND UPDATES

🔄 1 year of assistance and updates

📧 Email Support

💬 Live chat support

🤑 30-day Guarantee

Premium

€3,310

€1,490

per year

🎓 The new Financial Planning course (value €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value of €790)

NEWS: 4 Live 'Market Insights' events to discover behind-the-scenes of financial markets and become the finance expert among your colleagues and friends (value €390)

Everything included in the Smart plan

PLANNING SESSIONS

Assessment of the initial situation

Analysis of existing investments

Definition of steps and objectives

Financial plan assessment

Assessment of Insurance Holdings

12-month Check-up

End-of-year plan review

Analysis of areas for improvement

Savings verification

Private

Starting from

€4,900

per year

Everything included in the Premium plan

Customized and individual Financial Consulting

Dedicated 1:1 financial advisor

Dedicated to Net Worth over €500,000

The service has limited spots.

Money-back guarantee

No risk: if you are not satisfied, contact us within 30 days of purchase to receive a full refund.

Start your journey today

Join Plannix now

Create your account and start growing your holdings and securing your financial future today.

Paga in 3 rate con

Smart

€2,520

€990

per month for 3 months, every year (€990/year)

🎓 The new Financial Planning course (worth €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value €790)

NOVITÀ: 4 Eventi in diretta “Market Insights” per scoprire i retroscena dei mercati finanziari e diventare l’esperto di finanza tra i tuoi colleghi e amici (valore 390€)

Financial Growth

🔗 Automatic connection to your bank account for automatic tracking

📊 Asset and Investment Tracker

🔍 Financial Health Report and KPIs

💰 Detailed report of investment costs

Plan and Achieve Your Goals

📈 Create financial plans suited for you

🧮 Simulators and Calculators for informed decisions

📉 Optimize your investments with model portfolios

⚖️ Easy rebalancing to maintain portfolio equilibrium

💸 PAC: Guided Savings Plans for your investments

SUPPORT AND UPDATES

🔄 1 year of assistance and updates

📧 Email Support

💬 Live chat support

🤑 30-day Guarantee

Premium

€3,310

€1,490

per month for 3 months, each year (€1,490/year)

🎓 The new Financial Planning course (value €990)

🔐 The digital platform to guide you in planning your goals (value €490)

👛 Portafogli modello freschi di aggiornamento e pronti per il 2025 (valore 830 €)

💁 Assistenza sempre con te: risposte rapide via app ed email (valore 210 €)

🧑💼 3 financial planning sessions (value of €790)

NEWS: 4 Live 'Market Insights' events to discover behind-the-scenes of financial markets and become the finance expert among your colleagues and friends (value €390)

Everything included in the Smart plan

PLANNING SESSIONS

Assessment of the initial situation

Analysis of existing investments

Definition of steps and objectives

Financial plan assessment

Assessment of Insurance Holdings

12-month Check-up

End-of-year plan review

Analysis of areas for improvement

Savings verification

Private

Starting from

€4,900

per year

Everything included in the Premium plan

Customized and individual Financial Consulting

Dedicated 1:1 financial advisor

Dedicated to Net Worth over €500,000

The service has limited spots.

Money-back guarantee

No risk: if you are not satisfied, contact us within 30 days of purchase to receive a full refund.

The money you lost by not investing…

If you haven't invested anything for years, for every €100,000 not invested, you are losing at least €1,500 each year. With an average inflation rate of 3%, we let you imagine what happens when inflation skyrockets, like in recent years.

The money you lost by not investing…

If you haven't invested anything for years, for every €100,000 not invested, you are losing at least €1,500 each year. With an average inflation rate of 3%, we let you imagine what happens when inflation skyrockets, like in recent years.

The money you lost with your bank…

Perhaps instead you are investing with your bank in some junk fund (or, worse, a life insurance or wealth management policy) that costs 4% per year? Even in this case, for every €100,000 invested like this, you are burning €4,000. And do you know what the most atrocious thing is? That you don't even realize you are paying that money.

The money you lost with your bank…

Perhaps instead you are investing with your bank in some junk fund (or, worse, a life insurance or wealth management policy) that costs 4% per year? Even in this case, for every €100,000 invested like this, you are burning €4,000. And do you know what the most atrocious thing is? That you don't even realize you are paying that money.

Why postpone?

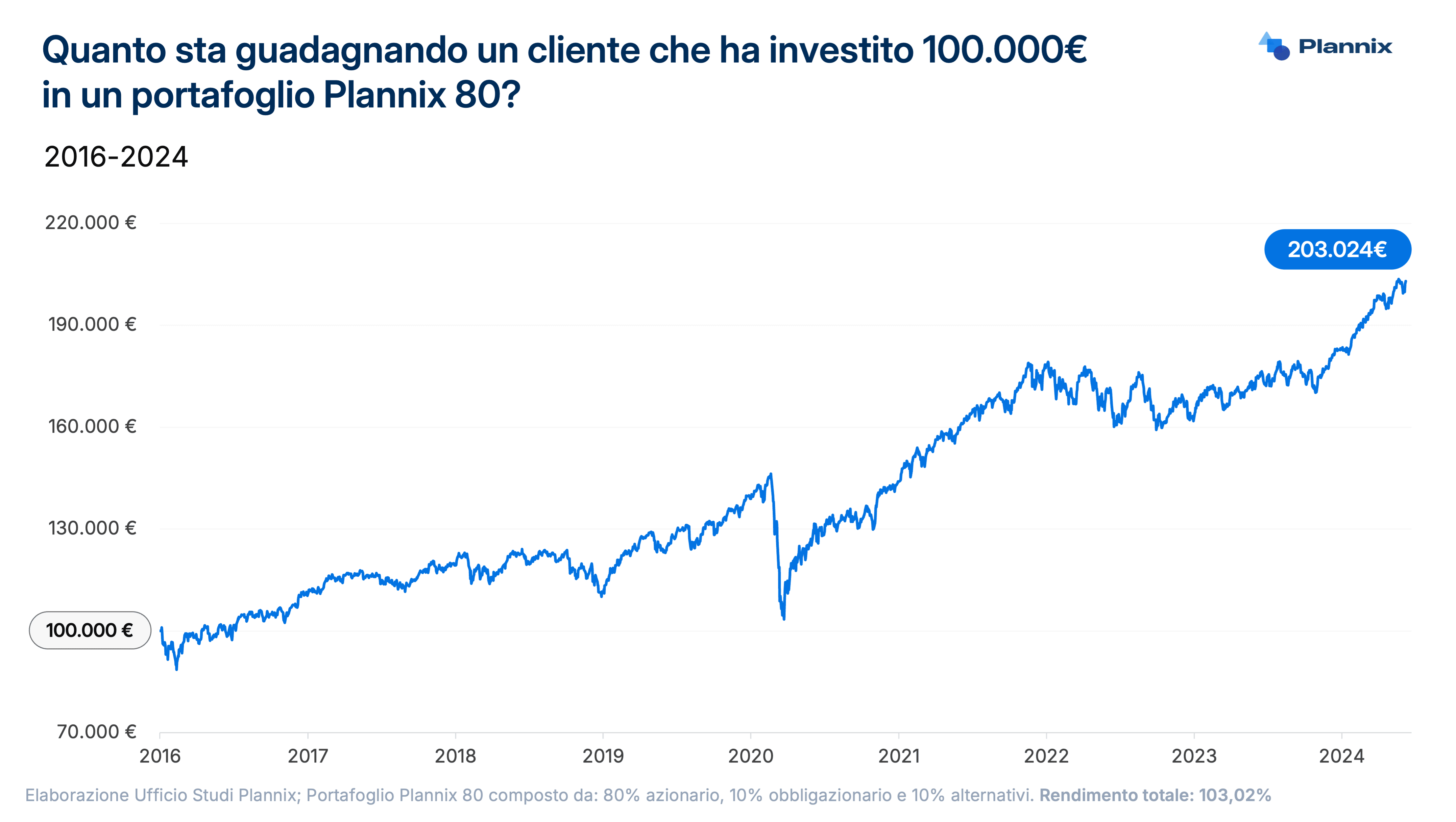

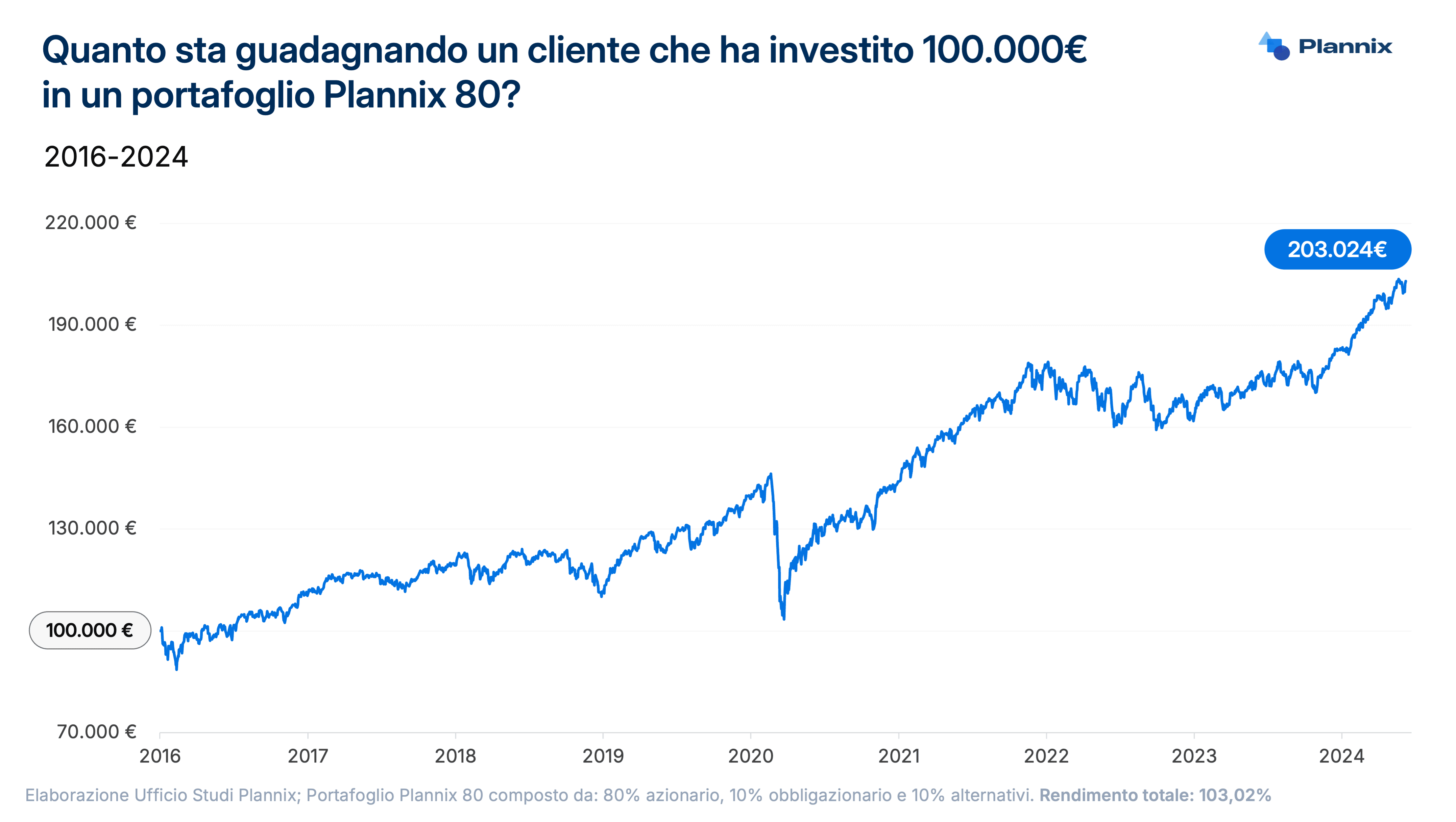

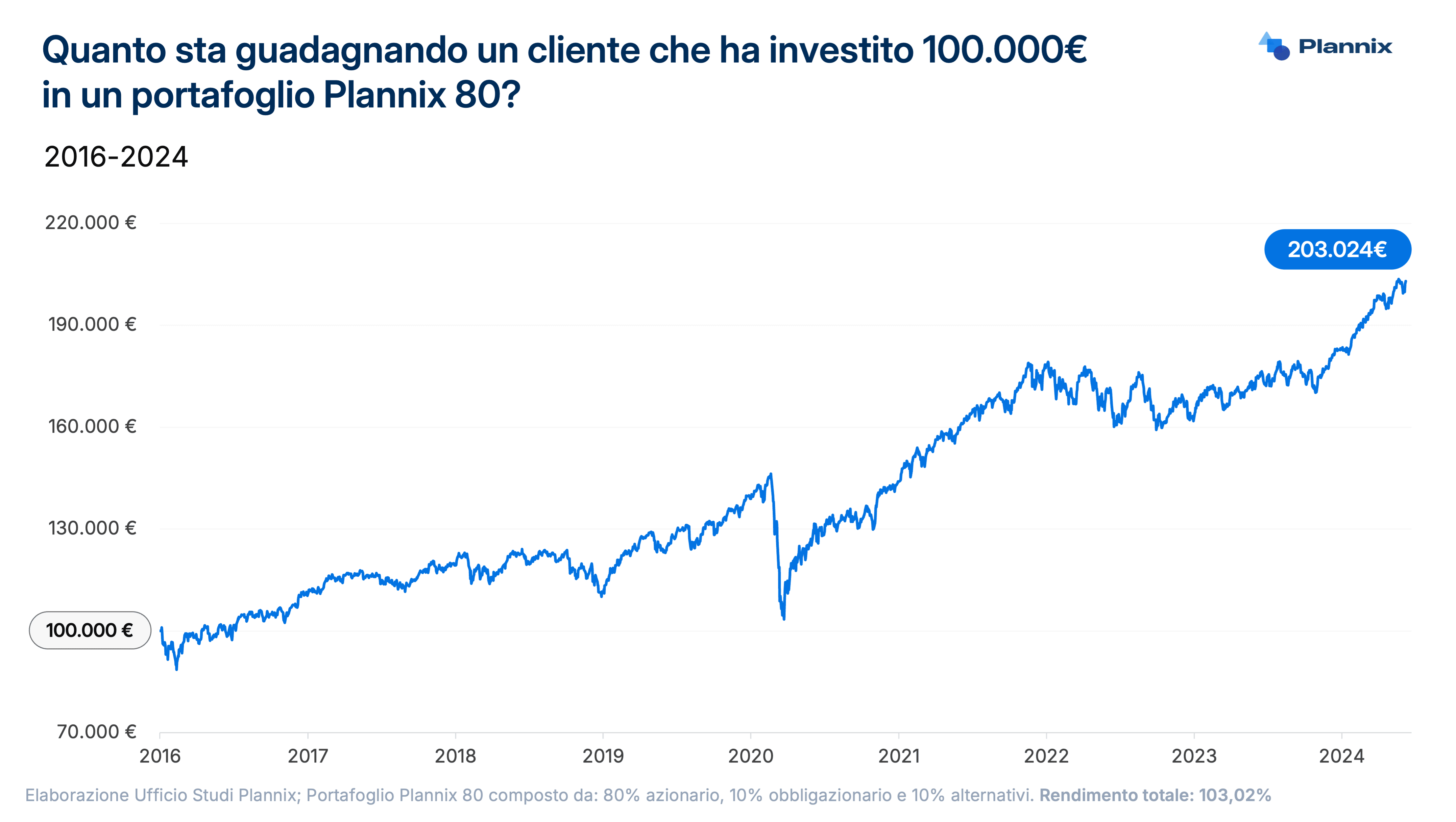

If you had invested €100,000 with Plannix, in 8 years you would have more than doubled

If you had invested €100,000 with Plannix, in 8 years you would have more than doubled

This is the trend of one of our model portfolios, the Plannix 80.

In 8 years you would have doubled your capital. €100,000 that turns into €203,024.

This is the performance of one of our model holdings, the Plannix 80. In 8 years you would have doubled your capital.

100,000€ becoming 203,024€.

This is the trend of one of our model portfolios, the Plannix 80.

In 8 years you would have doubled your capital. €100,000 that turns into €203,024.

The chart shows the evolution of a hypothetical model portfolio rebalanced annually from January 1, 2016, to June 6, 2024. The amounts should be understood for informational purposes only and before taxes and trading costs of the holdings. The model portfolios are based on what Plannix considers generally accepted investment theories. The model portfolios are developed solely for informational purposes and should not be regarded as investment advice or recommendation for particular securities, strategies, or investment products, nor as a solicitation to purchase or sell financial products.

Luca Lixi

Luca Lixi è un consulente finanziario indipendente e imprenditore con oltre vent’anni di esperienza nel mondo della finanza.

Dopo una lunga carriera maturata presso gruppi bancari internazionali, ha fondato Lixi Invest, società di formazione, alfabetizzazione ed educazione finanziaria digitale, (inserita tra le 1.000 aziende europee a crescita più rapida secondo la classifica Europe’s Fastest Growing Companies 2023 del Financial Time) e AEGIS SCF, Società di Consulenza Finanziaria Indipendente a Roma.

Dal 2022 lavora a tempo pieno sul progetto Plannix.

Luca Lixi è un consulente finanziario indipendente e imprenditore con oltre vent’anni di esperienza nel mondo della finanza.

Dopo una lunga carriera maturata presso gruppi bancari internazionali, ha fondato Lixi Invest, società di formazione, alfabetizzazione ed educazione finanziaria digitale, (inserita tra le 1.000 aziende europee a crescita più rapida secondo la classifica Europe’s Fastest Growing Companies 2023 del Financial Time) e AEGIS SCF, Società di Consulenza Finanziaria Indipendente a Roma.

Dal 2022 lavora a tempo pieno sul progetto Plannix.

Our customers

Built together with investors like you

Read the testimonials from over 500 satisfied customers.

I learned at 65 what I should have known at 18. In my particular case, I was able to review past mistakes, but also what good and correct things I managed to accomplish. Therefore, I made numerous adjustments to my holdings.

Piero Tonso

Surgeon

Plannix offers a safe guide even in stormy moments to be free savers. I can finally face financial uncertainties calmly and look forward to my future financial development, aided by an online platform designed to let me easily keep everything under control.

Matteo Dalvit

Product Manager

Plannix is the benchmark for financial planning, undoubtedly. Being aware and active players in one's financial choices is essential, and with Plannix this is reality.

Nicola Sargeni

Marketers and Advertisers

Even before being a computerized platform for managing one's money, Plannix is a unique educational and growth path of its kind. Believe me when I tell you that no bank employee will ever tell you what you will find in Plannix! It allows you to have a complete view not only of your financial situation but also, and above all, to see it connected to your goals (as of today, I am not aware of any home banking applications capable of doing this, except for some ultra-customized excel sheets that need to be updated manually).

Massimo Angelo

Impiegato

With just a single glance, you can see your financial situation and keep your investment goals monitored and updated. I am definitely now aware of which holdings I have in my portfolio, the time horizons of my investments, and their cost. And it's all simple and interactive.

Adamo Pe

Entrepreneur

Like so many people, a year ago on January 1st I made a promise to myself. It wasn't a new diet or the gym, but I joined Plannix because I thought my investments weren't getting me anywhere. I had thought about it a lot because the cost seemed 'high'. I can say that after a year with Plannix, I've removed all the 'managed' holdings that annually cost me much more than one year of Plannix.

Now I have a much clearer idea about my financial and insurance position and I'm creating portfolios suited to my different goals. I've also got an idea about my future pension, which isn't easy considering I have worked in different countries.

Inge Bulens

Airline pilot

I was able to recognize all the junk products I had and get rid of them. And I have finally started my long-term investment plan. Through the platform, I can monitor the performance of my holdings, without having to go crazy with Excel sheets, calculations, notes, etc.

Plannix has been the best investment I could make. I'm a different person now, and above all, I'm the one who sets the rules and decides what to do with my money.

Francesco Passarini

Software Developer

I found it very useful. It's a financial education tool, a planning tool, and a platform for monitoring your financial situation all in one place.

When dealing with various insurance and financial consultants, they are always the ones leading you to the product they want to sell; with Plannix, I had a clearer understanding of what I wanted to do with my money and how to plan my journey to reach my goals.

Carmen Leida

Agroforestry Expert

Plannix has shown me the actual possibilities of maintaining my savings and how to grow them wisely. I feel incredibly energized about my current and future investments, and I am calm about the management of my holdings. It has everything.

Elia Amorati

Marketer

I would recommend Plannix without hesitation to anyone wishing to get their financial life in order. It touches on all the essential points that an investor should know, yet it always remains focused on the practical and operational side.

Marco Bombardi

Entrepreneur

The Plannix platform has been like a quantum leap. The platform has brought together my entire financial life into a single dashboard. Readable at a glance, with truly useful keywords: I have joined in full control of what I hold. And the benefits are not just informational but also practical, very practical. After a short run-in period – by the way, the support is efficient and prompt – I saw what was wrong with my asset allocation, pruned the dead branches, and made everything more efficient. Without Plannix, I probably wouldn't have realized it.

Luca Clemente

Giornalista

Plannix allows you to follow a method that is robust and sensible. For those like me who have long been involved in financial markets (even with wrong choices), it primarily allows for smart, mature, and foresighted money management planning.

For those who know nothing about it, instead, it is an incredible starting point because it allows avoiding mistakes and becoming less fearful and confused about the steps to take.

Alberto Aldegheri

Employee

I can honestly say that Plannix is one of the best purchases I have ever made.

Remarkable and enlightening is the training on sound financial education that is totally lacking in Italy, and that has personally changed my life because today, thanks to the teachings of Plannix, I am a serene woman because I am informed and protected, and this for me is priceless.

But in my opinion, the real strength of Plannix is not just the content but the exceptional customer service; the Plannix team is extraordinary, they have always supported me and helped me in the difficulties I encountered in the development of my holdings and in suggesting the best solution.

Grace Corritore

Freelancer

It is absolutely one of the best products, with a huge practical confirmation of what is learned.

In a world where everything is available to everyone and no one knows where to really look for what they want, Plannix is a beacon that lights up the shadows of financial ignorance.

Clear, simple, and concise are the keywords to describe Plannix.Personally, I have now managed to have a clear path to follow and to implement all the ideas I had in mind that I was unable to carry out.

Arbnor Pronaj

Specialized Technician

I learned at 65 what I should have known at 18. In my particular case, I was able to review past mistakes, but also what good and correct things I managed to accomplish. Therefore, I made numerous adjustments to my holdings.

Piero Tonso

Surgeon

Plannix offers a safe guide even in stormy moments to be free savers. I can finally face financial uncertainties calmly and look forward to my future financial development, aided by an online platform designed to let me easily keep everything under control.

Matteo Dalvit

Product Manager

Plannix is the benchmark for financial planning, undoubtedly. Being aware and active players in one's financial choices is essential, and with Plannix this is reality.

Nicola Sargeni

Marketers and Advertisers

Even before being a computerized platform for managing one's money, Plannix is a unique educational and growth path of its kind. Believe me when I tell you that no bank employee will ever tell you what you will find in Plannix! It allows you to have a complete view not only of your financial situation but also, and above all, to see it connected to your goals (as of today, I am not aware of any home banking applications capable of doing this, except for some ultra-customized excel sheets that need to be updated manually).

Massimo Angelo

Impiegato

With just a single glance, you can see your financial situation and keep your investment goals monitored and updated. I am definitely now aware of which holdings I have in my portfolio, the time horizons of my investments, and their cost. And it's all simple and interactive.

Adamo Pe

Entrepreneur

Like so many people, a year ago on January 1st I made a promise to myself. It wasn't a new diet or the gym, but I joined Plannix because I thought my investments weren't getting me anywhere. I had thought about it a lot because the cost seemed 'high'. I can say that after a year with Plannix, I've removed all the 'managed' holdings that annually cost me much more than one year of Plannix.

Now I have a much clearer idea about my financial and insurance position and I'm creating portfolios suited to my different goals. I've also got an idea about my future pension, which isn't easy considering I have worked in different countries.

Inge Bulens

Airline pilot

I was able to recognize all the junk products I had and get rid of them. And I have finally started my long-term investment plan. Through the platform, I can monitor the performance of my holdings, without having to go crazy with Excel sheets, calculations, notes, etc.

Plannix has been the best investment I could make. I'm a different person now, and above all, I'm the one who sets the rules and decides what to do with my money.

Francesco Passarini

Software Developer

I found it very useful. It's a financial education tool, a planning tool, and a platform for monitoring your financial situation all in one place.

When dealing with various insurance and financial consultants, they are always the ones leading you to the product they want to sell; with Plannix, I had a clearer understanding of what I wanted to do with my money and how to plan my journey to reach my goals.

Carmen Leida

Agroforestry Expert

Plannix has shown me the actual possibilities of maintaining my savings and how to grow them wisely. I feel incredibly energized about my current and future investments, and I am calm about the management of my holdings. It has everything.

Elia Amorati

Marketer

I would recommend Plannix without hesitation to anyone wishing to get their financial life in order. It touches on all the essential points that an investor should know, yet it always remains focused on the practical and operational side.

Marco Bombardi

Entrepreneur

Plannix is the benchmark for financial planning, without a doubt. Being aware and active participants in one's financial choices is essential, and with Plannix, this is reality.

Nicola Sargeni

Marketer and Advertiser

Plannix is the benchmark for financial planning, without a doubt. Being aware and active participants in one's financial choices is essential, and with Plannix, this is reality.

Nicola Sargeni

Marketer and Advertiser

Plannix has shown me the real possibilities of maintaining my savings and how to grow them prudently. I feel incredibly energized about my current and future investments, and I am at ease with the management of my holdings. It's all there.

Elia Amorati

Marketer

Plannix has shown me the real possibilities of maintaining my savings and how to grow them prudently. I feel incredibly energized about my current and future investments, and I am at ease with the management of my holdings. It's all there.

Elia Amorati

Marketer

The Plannix platform has been like a quantum leap. The platform has brought together my entire financial life into a single dashboard. Instantly readable, with truly useful keywords: I've joined full control of what I hold. And the benefits are not purely informational but also practical, very practical. After a short break-in period – by the way, the support is efficient and quick – I've seen what was wrong with my asset allocation, pruned the dead branches and made everything more efficient. Without Plannix, I probably wouldn't have realized it.

Luca Clemente

Journalist

The Plannix platform has been like a quantum leap. The platform has brought together my entire financial life into a single dashboard. Instantly readable, with truly useful keywords: I've joined full control of what I hold. And the benefits are not purely informational but also practical, very practical. After a short break-in period – by the way, the support is efficient and quick – I've seen what was wrong with my asset allocation, pruned the dead branches and made everything more efficient. Without Plannix, I probably wouldn't have realized it.

Luca Clemente

Journalist

Like so many people, a year ago on January 1st, I made a promise to myself. It wasn't a new diet or going to the gym, but I joined Plannix because I had the idea that my investments weren't getting me anywhere. I had thought about it a lot because the cost seemed 'high'. I can say that after a year of Plannix, I’ve removed all the 'managed' holdings that used to cost me much more than 1 year of Plannix.

Now I have much clearer ideas about my financial and insurance position and am creating portfolios suitable for my different goals. I have also gotten a sense of my future retirement, which is not easy considering I’ve worked in different countries.

Inge Bulens

Airplane pilot

Like so many people, a year ago on January 1st, I made a promise to myself. It wasn't a new diet or going to the gym, but I joined Plannix because I had the idea that my investments weren't getting me anywhere. I had thought about it a lot because the cost seemed 'high'. I can say that after a year of Plannix, I’ve removed all the 'managed' holdings that used to cost me much more than 1 year of Plannix.

Now I have much clearer ideas about my financial and insurance position and am creating portfolios suitable for my different goals. I have also gotten a sense of my future retirement, which is not easy considering I’ve worked in different countries.

Inge Bulens

Airplane pilot

I managed to recognize all the junk products I had and got rid of them. And I finally started my long-term investment plan. Through the platform, I can monitor the performance of my holdings, without having to go crazy with Excel sheets, calculations, notes, etc.

Plannix has been the best investment I could make. I am a different person now, and most importantly, I am the one who sets the rules and decides what to do with my money.

Francesco Passarini

Software Developer

I managed to recognize all the junk products I had and got rid of them. And I finally started my long-term investment plan. Through the platform, I can monitor the performance of my holdings, without having to go crazy with Excel sheets, calculations, notes, etc.

Plannix has been the best investment I could make. I am a different person now, and most importantly, I am the one who sets the rules and decides what to do with my money.

Francesco Passarini

Software Developer

I can honestly say that Plannix is one of the best purchases I have ever made.

The extraordinary and enlightening training on solid financial education that is totally lacking in Italy, and that has personally changed my life because today, thanks to the teachings of Plannix, I am a calm woman because I am informed and protected and this is priceless for me.

But in my opinion, the real strength of Plannix is not only the contents but the exceptional customer service, the Plannix team is extraordinary, they have always supported and helped me through the challenges encountered in the development of my holdings and in suggesting the best solution.

Grazia Corritore

Freelancer

I can honestly say that Plannix is one of the best purchases I have ever made.

The extraordinary and enlightening training on solid financial education that is totally lacking in Italy, and that has personally changed my life because today, thanks to the teachings of Plannix, I am a calm woman because I am informed and protected and this is priceless for me.

But in my opinion, the real strength of Plannix is not only the contents but the exceptional customer service, the Plannix team is extraordinary, they have always supported and helped me through the challenges encountered in the development of my holdings and in suggesting the best solution.

Grazia Corritore

Freelancer

I learned at 65 what I should have known at 18. In my specific case, I was able to review the mistakes made in the past, but also the good and right things I was able to achieve. Therefore, I have made numerous corrections to my holdings.

Piero Tonso

Surgeon

I learned at 65 what I should have known at 18. In my specific case, I was able to review the mistakes made in the past, but also the good and right things I was able to achieve. Therefore, I have made numerous corrections to my holdings.

Piero Tonso

Surgeon

Join

Join Plannix now

Join Plannix now

Start today to take care of your financial future and grow your savings.

Frequently Asked Questions

Frequently Asked Questions

If you have any other questions, click on the button for the chat down here on the bottom right or send an email to support@plannix.co

What is Plannix?

Plannix is the platform that helps individual investors and savers to grow their savings and obtain a clear overview of their financial situation through analysis tools, monitoring, and practical planning. The subscription includes joining the educational area, the model portfolios, and the assistance.

What is Plannix?

Plannix is the platform that helps individual investors and savers to grow their savings and obtain a clear overview of their financial situation through analysis tools, monitoring, and practical planning. The subscription includes joining the educational area, the model portfolios, and the assistance.

What is the recommended minimum holding to get started?

What is the recommended minimum holding to get started?

Do you offer individual financial planning services?

Do you offer individual financial planning services?

Are investments made directly from the platform?

Are investments made directly from the platform?

How long will it take for me to be up and running?

How long will it take for me to be up and running?

Is Plannix also suitable for those who know nothing about finance?

Is Plannix also suitable for those who know nothing about finance?

I do not live in Italy. Is Plannix suitable for me?

I do not live in Italy. Is Plannix suitable for me?

Is there a free version?

Is there a free version?

Can I cancel my subscription without any constraints?

Can I cancel my subscription without any constraints?

How do you connect to the accounts?

How do you connect to the accounts?

Still have any questions?

If you still have questions, click on the blue chat icon at the bottom right.

Office

Piazza IV Novembre, 7 Milan - 20124

Plannix SCF is an Independent Financial Consultancy Company authorized by Resolution No. 2461 of the OCF of Milan on 04/23/2024.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

This informational page is intended purely for informational and marketing purposes on behalf of Plannix SCF srl. The information contained herein does not constitute and cannot be interpreted as investment advice or an invitation or recommendation in favor of particular securities, strategies, or investment products, nor a solicitation to purchase or sell financial products or to carry out any other kind of financial transaction. Any investment decision made in relation to the content of this informational page or to the contents accessible on the Plannix platform is the sole responsibility of the investor who must consider the Plannix software as a tool for analysis, tracking, information, and support for his or her personal investment decisions. The Plannix platform does not perform and cannot carry out financial transactions for or on behalf of registered clients and does not provide nor can provide specific recommendations in favor of particular securities, strategies, or investment products; the Plannix software is solely used for illustrative purposes to facilitate users in independently viewing their own assets and investments. Although Plannix SCF srl makes every reasonable effort to ensure the highest quality of the services provided, the Plannix software and Plannix SCF srl do not provide any expressed or implied warranty on the correctness, completeness, timeliness, or accuracy of the information, assignments, rates, indices, prices, calculations, analyses, market data, and other content accessible as part of the services offered on app.plannix.co. All investments carry the risk of loss.

© 2025

Plannix Società di Consulenza Finanziaria Srl - VAT ID 12983770962

Plannix is the platform that helps you monitor assets, holdings, and investments to create a winning financial plan.

Plannix SCF is an Independent Financial Consulting Company authorized by resolution no. 2461 of the OCF of Milan dated 04/23/2024.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

Office

Piazza IV Novembre, 7 Milan - 20124

© 2025

Plannix Società di Consulenza Finanziaria Srl - VAT ID 12983770962

This informational page serves solely for informational and marketing purposes by Plannix SCF Ltd. The information contained within does not constitute and cannot be interpreted as investment advice or an invitation or recommendation for particular securities, investment strategies or products, or a solicitation to buy or sell financial products or to engage in any other financial transaction. Any investment decision made in relation to the content of this informational page or the contents accessible on the Plannix platform is the sole responsibility of the investor, who should regard the Plannix software as a tool for analysis, tracking, information, and support for their personal investment decisions. The Plannix platform does not perform and cannot perform financial transactions for or on behalf of registered clients and does not and cannot provide specific recommendations for particular securities, strategies, or investment products; the Plannix software is used only for illustrative purposes to facilitate independent viewing by users of their assets and investments. Although Plannix SCF Ltd undertakes every reasonable effort to ensure the highest quality of services provided, Plannix software and Plannix SCF Ltd do not provide any express or implied warranty as to the correctness, completeness, timeliness, or accuracy of the information, allocations, rates, indexes, prices, calculations, analyses, market data, and other content accessible within the services offered on app.plannix.co. All investments are subject to the risk of loss.

The information on this page is for informational and marketing purposes only by Plannix SCF srl. The information contained herein does not constitute and should not be interpreted as investment advice or an invitation or recommendation in favor of particular securities, strategies or investment products, or as a solicitation to buy or sell financial products or to carry out any other financial transaction. Any investment decision made in relation to the content of this informational page or to the contents accessible on the Plannix platform is the sole responsibility of the investor, who should consider the Plannix software as a tool for analysis, tracking, information, and support for their personal investment decisions. The Plannix platform does not execute and cannot execute financial transactions for or on behalf of registered clients and does not provide nor can provide specific recommendations in favor of particular securities, strategies or investment products; the Plannix software is used only for illustrative purposes to facilitate users' independent visualization of their holdings and investments. Although Plannix SCF srl undertakes every reasonable effort to ensure the highest quality of the services provided, the Plannix software and Plannix SCF srl do not provide any express or implied warranty on the correctness, completeness, timeliness, or accuracy of the information, assignments, rates, indices, prices, calculations, analyses, market data, and other contents accessible within the services offered on app.plannix.co. All investments are subject to the risk of loss.

Office

Piazza IV Novembre, 7 Milan - 20124

Plannix is the platform that helps you grow your holdings and secure your financial future.

Plannix SCF is an Independent Financial Consultancy Company authorized by Resolution No. 2461 of the OCF of Milan on 04/23/2024.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

Plannix SCF is part of AssoSCF, the Italian Association of Independent Financial Consulting Companies.

© 2025

Plannix Società di Consulenza Finanziaria Srl - VAT ID 12983770962